Condsidering Chapter 7 Bankruptcy?

If you are considering filing for bankruptcy and are unsure of which type of bankruptcy is best for you, our Southfield, MI Chapter 7 bankruptcy lawyer lawyer can help you make an informed decision. Filing for bankruptcy is an important decision that requires a great amount of care and consideration.

We understand how impactful this decision is on your life, and we will work hard to ensure that you understand the full implications of your decision and that the process of filing for bankruptcy is handled efficiently, legally, and in the best manner possible for you. To discuss your situation with a lawyer, contact our team at Gudeman & Associates, P.C. to schedule a consultation today.

Understanding Chapter 7 Bankruptcy

Chapter 7 bankruptcy is also commonly referred to as “liquidation bankruptcy” or “straight bankruptcy.” This type of bankruptcy is for people who simply cannot afford to pay debt to unsecured creditors. This may include credit card debt, medical debt, and more. Chapter 7 bankruptcy is designed to eliminate debts quickly, often within four months or less. It will temporarily prevent foreclosures or repossessions of your property, but Chapter 7 bankruptcy does not include a repayment plan. If you hope to save your property by catching up on payments, filing for Chapter 13 or Chapter 11 bankruptcy may be best for you.

There are many potential benefits of Chapter 7 bankruptcy. Some benefits may be more helpful than others depending on your unique situation. Our Southfield Chapter 7 bankruptcy lawyer will help you understand the benefits of Chapter 7 bankruptcy and make an informed decision on if it is the right step for you.

Some benefits of Chapter 7 bankruptcy are that it temporarily prevents home foreclosure and car repossession, it involves no repayment, it can eliminate credit card debt and personal loans, it can discharge medical bills, it can resolve certain tax debts, and it is a relatively quick process.

Chapter 7 Bankruptcy Means Test

To qualify to file for Chapter 7 bankruptcy, you must pass a means test. This test analyzes income over the past six months and is meant to determine if an individual filing for Chapter 7 bankruptcy is receiving enough income to gradually repay debts. Typically, individuals with annualized monthly income less than the median household income for a household for their size will pass the means test. If this is not the case for you, there are still potential ways to pass the means test. Our Southfield Chapter 7 bankruptcy lawyer will investigate your situation and determine if there are circumstances that make you eligible to file for Chapter 7 bankruptcy.

The Importance of Legal Representation

With a process as complicated and important as filing for bankruptcy, enlisting the aid of an experienced Chapter 7 bankruptcy lawyer is imperative. Our team will consult with you on your situation, advise you on the best steps forward, and represent you throughout the entire process of filing for bankruptcy. We are here to serve as a source of comfort and guidance during a difficult time, and to help you make the best decision for your future. To discover more about how we can help you, contact Gudeman & Associates, P.C. today.

How Bankruptcy Can Protect Your Assets

Filing for bankruptcy with a Southfield, MI Chapter 7 bankruptcy lawyer can be a daunting decision, but it can also provide significant relief and protection for individuals facing overwhelming debt. One of the key benefits of Chapter 7 bankruptcy is its ability to help protect your assets from creditors and provide you with a fresh financial start. Here’s how Chapter 7 bankruptcy can help safeguard your assets and provide you with much-needed debt relief.

Immediate Protection From Creditors

One of the most significant advantages of filing for Chapter 7 bankruptcy is the automatic stay, which goes into effect as soon as you file your bankruptcy petition. The automatic stay prohibits creditors from taking any further collection actions against you, including foreclosure, repossession, wage garnishment, or harassing phone calls and letters. This immediate protection can provide you with much-needed relief from the stress and anxiety of dealing with aggressive creditors.

Liquidation Of Non-Exempt Assets

Chapter 7 bankruptcy involves the liquidation of non-exempt assets to pay off your creditors. However, many people mistakenly believe that they will lose all of their assets in Chapter 7 bankruptcy. In reality, each state has its own set of exemptions that allow you to protect certain types and amounts of property from liquidation. By carefully planning and utilizing available exemptions, you can protect most, if not all, of your assets from liquidation in Chapter 7 bankruptcy. A knowledgeable lawyer can walk through all your assets and let you know what is safe.

Discharge Of Unsecured Debts

Another key benefit of Chapter 7 bankruptcy is the discharge of unsecured debts, such as credit card debt, medical bills, personal loans, and utility bills. Once your Chapter 7 bankruptcy case is successfully completed, these debts are eliminated, and you are no longer legally obligated to repay them. This can provide you with a fresh financial start and allow you to move forward with your life without the burden of overwhelming debt hanging over your head.

Preservation Of Future Income

In addition to protecting your current assets, a Southfield Chapter 7 bankruptcy lawyer can also help protect your future income from being garnished by creditors. Once your debts are discharged in Chapter 7 bankruptcy, creditors are prohibited from pursuing further collection actions against you. This means that your future earnings are protected, allowing you to rebuild your finances and work towards a brighter financial future. If you hear from creditors even after filing, you should contact your attorney to let them know.

If you’re considering filing for bankruptcy with a Southfield Chapter 7 bankruptcy lawyer and want to learn more about how this process can help protect your assets, don’t hesitate to contact the experienced attorneys at Gudeman & Associates, P.C. We understand the complexities of Chapter 7 bankruptcy law and can provide you with personalized legal guidance and representation throughout the bankruptcy process. Contact us today to schedule a consultation and take the first step towards achieving financial freedom and peace of mind. Reach out today to get started.

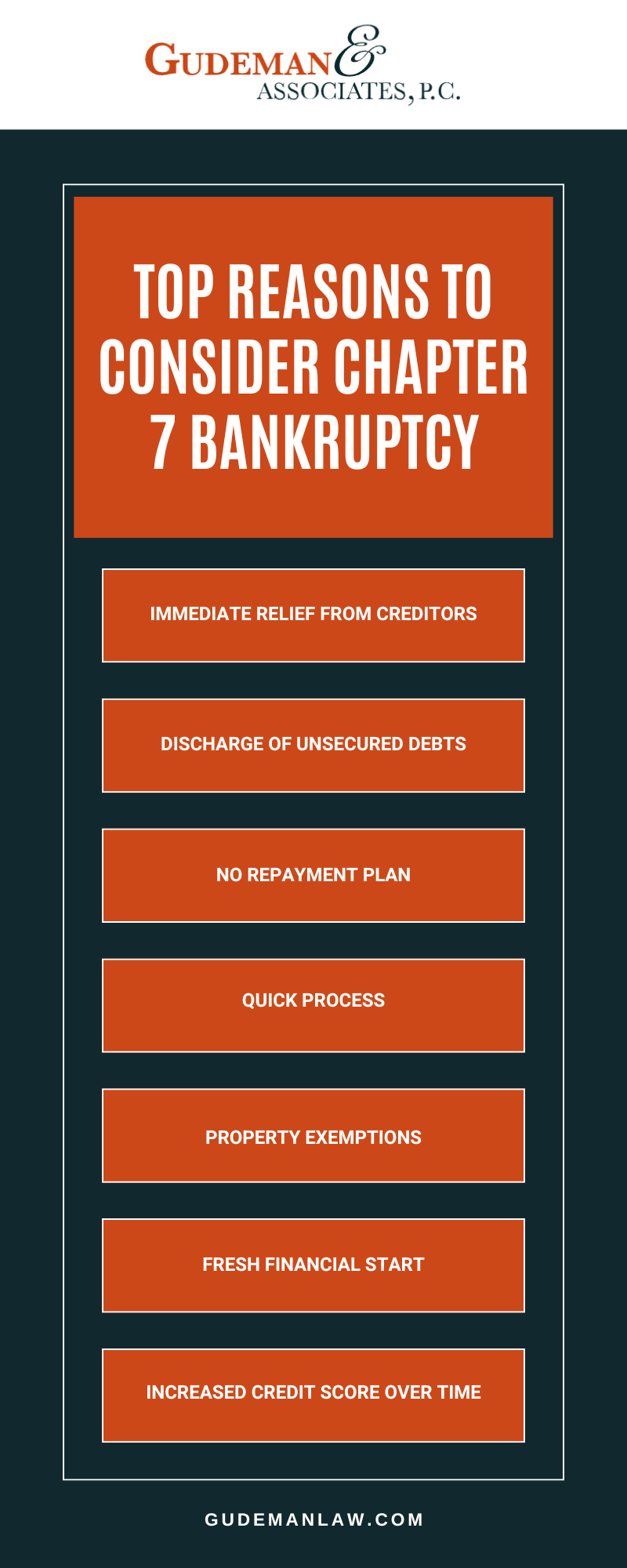

Top Reasons To Consider Chapter 7 Bankruptcy

We want to shed some light on the benefits of filing for a Southfield Chapter 7 bankruptcy. Here are the top reasons to consider bankruptcy as a viable option for regaining control of your financial situation.

Immediate Relief From Creditors

The moment you file for a Southfield Chapter 7 bankruptcy, an automatic stay goes into effect. This stay halts most creditors from continuing with collection activities, including harassing phone calls, wage garnishments, and lawsuits. This immediate relief gives you the breathing room to reorganize your finances without the constant pressure from creditors.

Discharge Of Unsecured Debts

One of the most significant benefits of Chapter 7 is the discharge of unsecured debts. This includes credit card debt, medical bills, and personal loans. After a successful Chapter 7 process, these debts are wiped out, giving you a clean slate. It’s important to remember, however, that not all debts can be discharged. Debts like student loans, child support, and certain tax obligations will remain.

No Repayment Plan

Unlike Chapter 13 bankruptcy, Chapter 7 doesn’t require you to pay back debts through a repayment plan. For many in Southfield, this is a crucial factor. If you’re facing financial hardship and don’t have the means to commit to a multi-year repayment plan, Chapter 7 offers a more straightforward path to debt relief.

Quick Process

The process of a Southfield Chapter 7 bankruptcy is relatively quick. Most cases are completed within 3-6 months from filing to discharge. This speedy process means you can start rebuilding your financial life sooner rather than later.

Property Exemptions

Many people fear that filing for bankruptcy means losing everything they own, but this is not the case. Michigan law provides several exemptions that allow you to keep essential property like a portion of the equity in your home, your vehicle, personal belongings, retirement accounts, and more. We can help you understand how these exemptions apply to your specific situation.

Fresh Financial Start

Perhaps the most compelling reason to consider Chapter 7 is the opportunity for a fresh start. After the discharge of your debts, you are no longer burdened by past financial mistakes or unforeseen circumstances that led you to this point. This fresh start is a chance to rebuild your credit, make sound financial decisions, and move forward with a cleaner financial slate.

Increased Credit Score Over Time

It’s a common misconception that bankruptcy ruins your credit forever. In reality, while your credit score does take an initial hit, many people find that their credit score improves more quickly post-bankruptcy than if they continued struggling with unmanageable debt.

Get In Touch With Us Today To Learn More

At Gudeman & Associates, P.C., we understand that the decision to file for bankruptcy is not easy. We’re here to provide you with the information and support you need to make the best choice for your unique situation. If you’re considering Southfield Chapter 7 bankruptcy, or just want more information about your options, reach out to us. Let’s work together to put you on the path to a more secure financial future.

Southfield Chapter 7 Bankruptcy Infographic

Chapter 7 Bankruptcy FAQs

If you’re overwhelmed by debt and unsure of what to do next, filing for Chapter 7 bankruptcy should be on your list of considerations. At Gudeman & Associates, P.C., we help people understand their options and determine whether Chapter 7 is the right choice for their situation. Below, we’ve answered a few of the most frequent questions we hear about the Chapter 7 process.

What Can I Lose If I File Chapter 7?

If you file for Chapter 7 without applying the proper exemptions, you could lose certain assets to the bankruptcy trustee. This includes property that is considered non-exempt, such as a second vehicle, valuable jewelry, investment accounts, or vacation homes. The trustee has the authority to sell these non-exempt assets to repay your creditors.

However, both Michigan and federal law allow you to protect specific types of property through exemptions, such as your primary residence (up to a certain value), one vehicle, retirement accounts, and basic household goods. When exemptions are applied correctly, you may be able to keep everything you own. Our Southfield Chapter 7 bankruptcy lawyer can help you identify which assets are protected and make sure your exemptions are properly applied.

What’s The Difference Between Chapter 7 And Chapter 13?

The key difference comes down to how debt is handled. Chapter 7 is a liquidation process that wipes out most unsecured debts, such as credit cards and medical bills, without requiring a repayment plan. It typically takes about three to four months to complete.

Chapter 13, on the other hand, sets up a three- to five-year repayment plan based on your income. Chapter 13 may be a better fit if you’re behind on your mortgage or car loan and want to catch up while keeping your assets. Our experienced Michigan bankruptcy attorneys can help you evaluate which option best fits your financial situation.

What Disqualifies Someone From Being Able To File?

There are several factors that may prevent you from filing Chapter 7. If your income is too high based on the means test (which compares your income to the median in Michigan) you may not qualify.

You’re also ineligible if you’ve had a Chapter 7 discharge in the past eight years or a Chapter 13 discharge in the past six years. Fraudulent activity, such as hiding assets or submitting false documents, can also disqualify you. We’ll walk through your financial history with you to determine if you meet the requirements.

Will My Credit Score Be Impacted?

Yes, filing for Chapter 7 will impact your credit score. The bankruptcy will appear on your credit report for up to 10 years.

However, many people who are considering bankruptcy already have significant damage to their credit from missed payments, high balances, or collection accounts. Chapter 7 can stop the bleeding and give you a chance to rebuild your credit over time. Some people even start seeing improvement within a year of discharge by making consistent payments and using secured credit responsibly.

How Can A Lawyer Help Me?

Filing for bankruptcy involves more than just filling out paperwork. Your lawyer can review your financial records, determine which assets are protected, complete and file all required documents, and represent you in court. Mistakes in the filing process can delay your case or result in dismissed claims. Our Chapter 7 bankruptcy lawyers will help you avoid common errors, answer your questions throughout the process, and make sure you’re on solid ground moving forward.

Find Your Best Path Forward

If you’re ready to take the next step, our Southfield Chapter 7 bankruptcy lawyer is here to support you. At Gudeman & Associates, P.C., we’ll work with you to understand your financial picture and identify the best way forward for you and your household. Contact us today to start building a stronger financial future.