Running a business is tough enough without having to worry about the legal side of things. That’s where our Troy MI business lawyer with Gudeman & Associates, P.C. steps in. We’re proud to be the go-to legal team for businesses across Southeast Michigan. With over 100 years of combined experience, an A+ rating from the Better Business Bureau, and a deep commitment to serving our community, we’ve built a reputation for helping businesses thrive. Whether you need help with contracts, financial struggles, or navigating complicated regulations, we’re here to guide you every step of the way. Contact us today to see how we can make your business’s legal challenges a thing of the past.

Why Every Business Needs a Trusted Legal Partner

Let’s face it, most business owners don’t start their company because they love dealing with legal documents. Our team of professionals works diligently to be your legal lifeline. They handle the details so you can focus on running your business. Need help drafting a contract or reviewing one? We’ve got you. Dealing with compliance issues or a disagreement with a vendor? We’ll step in to protect your interests. Thinking about restructuring or dissolving your business? We work to make sure you do it the right way, with minimal stress.

Financial struggles are something many businesses face at some point. If you’re overwhelmed by debt or dealing with creditor calls, we may help you figure out a way forward. Even if that means restructuring your finances or helping you file for bankruptcy, we’ll make certain you understand your options and feel confident in your choices.

Protecting Your Business with Legal Support

Doing business requires managing a lot of legal requirements and staying compliant with both Michigan and federal laws. That’s no small task, but our Troy business lawyers take the guesswork out of the equation, helping you avoid costly mistakes and assuring that your business runs smoothly.

Having a trusted legal partner means you can handle challenges like tax compliance, employee disputes, or financial hurdles without fear of tripping over legal red tape. Our team of professionals will take the time to get to know your business and your goals so we may offer advice that makes sense for you. We know Southeast Michigan’s business scene is full of opportunities, but it’s also highly competitive, and hiring our business attorney can give you a real edge.

Let’s Solve Your Legal Challenges Together

Your business deserves the best local support, and that’s exactly what we offer at Gudeman & Associates, P.C. We’re more than just Troy business lawyers, we’re your partners in success. If you’re facing a tough legal issue or just want to make sure your business is set up for the future, we’re here to help.

Once you’re ready to get started, contact our business attorney today for a no-obligation consultation. Let’s work together to protect your business, tackle legal challenges, and keep you focused on doing what you do best, running a successful business.

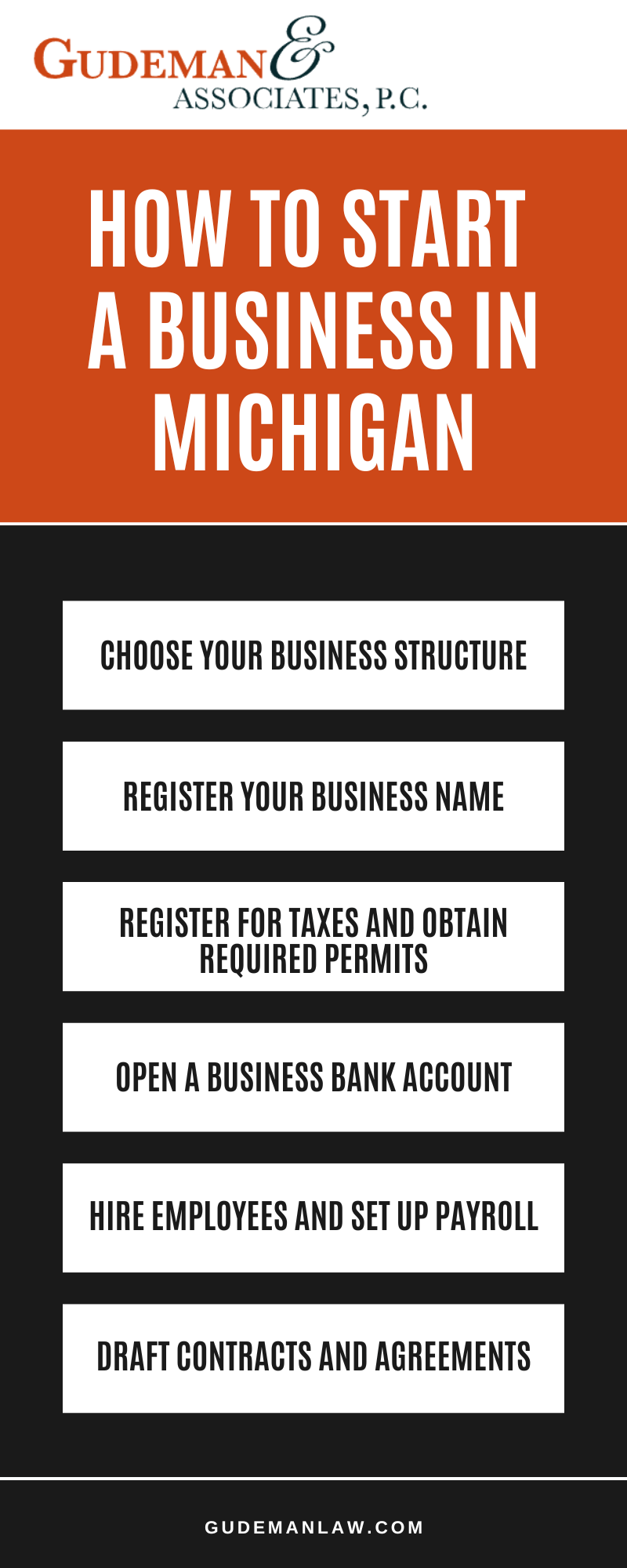

How To Start A Business In Michigan

Starting a business in Michigan can be an exciting and rewarding venture. However, before you dive into the entrepreneurial world, it’s important to have a clear plan and an understanding of the legal requirements involved. Our Troy, MI business lawyer can help guide you through the necessary steps for a smooth and successful business launch. At Gudeman & Associates, P.C., our experienced team has helped countless clients in Southern Michigan with their business formation and compliance needs. We’ll walk you through the essential steps to starting a business in Michigan.

Choose Your Business Structure

One of the first decisions you’ll need to make is determining what type of business structure is best for your needs. The structure you choose will have a significant impact on your taxes, liability, and other factors. The most common types of business structures in Michigan are:

- Sole Proprietorship

- Limited Liability Company (LLC)

- Corporation

- Partnership

Each structure has its own advantages and disadvantages, and it’s important to consult with our Troy business attorneys to determine which one will serve you best. Our business compliance lawyers can help you evaluate the potential risks and benefits of each option to make sure that you’re making an informed choice.

Register Your Business Name

Once you’ve chosen your business structure, it’s time to select a name for your business. In Michigan, you’ll need to check the availability of your business name through the Michigan Department of Licensing and Regulatory Affairs (LARA). Our corporate attorneys can assist in making sure that your business name is properly registered and protected under Michigan law.

Register For Taxes And Obtain Required Permits

Before you begin operating your business, you must verify that you’re compliant with Michigan’s tax requirements. This includes obtaining a federal Employer Identification Number (EIN) from the IRS.

In addition to federal taxes, you may need to register for Michigan state taxes, such as sales tax, use tax, and unemployment insurance tax, depending on the nature of your business. You’ll also need to acquire any permits or licenses required for your specific type of business. Depending on your industry, there may be local, state, or federal regulations that require you to obtain permits.

Open A Business Bank Account

Keeping your personal and business finances separate is essential for managing your company’s finances. Opening a business bank account will help you track expenses, receive payments, and maintain proper financial records. If you’re unsure about how to properly manage your finances, we can provide advice on setting up and maintaining financial systems that meet legal standards.

Hire Employees And Set Up Payroll

If your business will have employees, you’ll need to follow the necessary steps to hire and pay them legally. This includes complying with Michigan and federal labor laws, setting up a payroll system, and providing the required employee benefits. You will also need to file employment taxes and provide workers’ compensation insurance.

Draft Contracts And Agreements

As your business begins to operate, it’s important to have legal agreements in place to protect your interests. We can help you draft and review contracts that are clear, enforceable, and protect your business’s rights. In addition to drafting contracts, you may also encounter situations where business litigation becomes necessary. Our business litigation lawyers can provide the guidance you need to resolve conflicts effectively and protect your business interests.

Another consideration as your business grows is the possibility of bankruptcy. If you face financial difficulties, it’s essential to consult with our bankruptcy lawyers who can help you understand your options and protect your business during tough times. Whether it’s restructuring or liquidation, having the right legal representation can make all the difference in helping your business weather financial storms.

Let Us Help You Build A Strong Business Foundation

Starting a business in Michigan comes with various legal considerations. With over 100 years of combined experience, our Troy business lawyers from Gudeman & Associates, P.C. can assist you in every step of the process, from selecting the right business structure to verifying compliance with state and federal regulations. Contact us today to schedule a consultation and get the legal support you need to start your business on the right foot.

Types of Business Cases We Handle

Running a business means making decisions every day that can affect your growth, profitability, and long-term stability. From formation to expansion, and sometimes dispute resolution, having the right legal guidance in place is critical. At Gudeman & Associates, P.C., we provide full-service legal solutions for businesses, helping owners overcome challenges with confidence and clarity. With over 100 years of combined experience, our team serves as a trusted legal partner for companies at every stage of the business lifecycle. Our Troy, MI business lawyer goes beyond reacting to problems. We help business owners plan strategically, reduce risk, and protect what they’ve built. Below are the primary types of business cases we handle and how we support our clients through each one.

Business Formation and Entity Selection

Choosing the right legal structure is one of the most important decisions a business owner makes. We advise entrepreneurs and established companies on forming corporations, limited liability companies (LLCs), partnerships, and other entities based on liability exposure, tax considerations, and long-term goals. Our team handles formation documents, operating agreements, bylaws, and compliance requirements, making sure that your business starts on solid legal footing.

Strategic Business Planning and Advisory Services

Legal planning is a key component of successful business strategy. We work closely with owners, executives, and stakeholders to align legal structures with business objectives. Whether you’re preparing for expansion, restructuring operations, or planning for succession, we provide proactive legal insight designed to support sustainable growth and minimize future disputes.

Contract Drafting, Review, and Negotiation

Contracts are the backbone of nearly every business relationship. Poorly drafted agreements can expose your company to unnecessary risk, while strong contracts help prevent misunderstandings before they arise. We draft, review, and negotiate a wide range of business contracts, including vendor agreements, service contracts, employment agreements, non-compete clauses, and licensing arrangements. Our goal is to protect your interests while supporting efficient, practical business operations.

Business Litigation and Dispute Resolution

Even with careful planning, disputes can arise. When they do, we represent businesses in commercial litigation involving breach of contract, shareholder disputes, partnership conflicts, and other business-related claims. We approach litigation strategically—seeking efficient resolutions whenever possible while remaining fully prepared to advocate aggressively in court when necessary. Our experience allows us to assess risk early and guide clients toward informed decisions throughout the process.

Partnership Disputes and Buy-Sell Agreements

Business partnerships can be powerful, but they can also become complicated when priorities shift or conflicts emerge. We assist clients with drafting and enforcing partnership agreements and buy-sell agreements that clearly define ownership rights, exit strategies, and dispute resolution mechanisms. When disagreements arise between partners or shareholders, we work to protect our clients’ interests and preserve the value of the business whenever possible.

Corporate Governance and Ongoing Compliance

Maintaining proper governance is essential for protecting business owners from personal liability and preserving the integrity of the company. We advise businesses on corporate governance matters, including shareholder meetings, recordkeeping, fiduciary duties, and regulatory compliance. By staying proactive, our Troy business lawyer helps clients avoid legal exposure that can arise from overlooked formalities.

Business Transitions, Sales, and Succession Planning

Whether you’re selling a business, acquiring another company, or planning for leadership transition, legal guidance is critical. We assist with due diligence, transactional documentation, and strategic planning to facilitate smooth transitions that align with our clients’ financial and operational goals.

Trusted Legal Support for Your Business

At Gudeman & Associates, P.C., we understand that every business decision carries legal implications. That’s why we offer full-service legal solutions for businesses, tailored to the realities of running a company in today’s competitive environment. With over 100 years of combined experience, our attorneys bring depth, perspective, and practical insight to every matter we handle. If you’re looking for a reliable Troy business lawyer who understands both legal risk and business strategy, we’re here to help. Schedule a no-obligation consultation today and learn how our team can support your business, now and into the future.

Ways A Business Lawyer Can Save You Money Long-Term

Running a business comes with unexpected costs, but working with the right legal team can help protect your bottom line. At Gudeman & Associates, P.C., we know how important it is to keep your operations running smoothly while avoiding unnecessary expenses. Here are a few key ways our Troy business lawyer can help you save money over time:

Drafting Solid Contracts

Clear contracts are the foundation of any successful business. When agreements leave out key details, it often leads to disputes that cost time and money. We help you avoid this by writing contracts that are specific, thorough, and built around your business needs.

For example, we might draft a service agreement that clearly defines payment terms, project deadlines, and responsibilities to prevent clients from disputing invoices. Or, we can prepare employment contracts that outline job duties and termination procedures to reduce the risk of wrongful termination claims.

No matter what documents you need drafted or revised, we can help you make sure your contracts aren’t just legally sound but also practical for the day-to-day work you do, saving you from costly headaches later.

Preventing Legal Disputes

Business disputes can quickly drain time and resources. By reviewing agreements, advising on employment practices, and setting up clear business policies, we help you avoid problems before they become expensive legal battles. Partnering with our Michigan business attorneys early on is often much less expensive than dealing with a lawsuit later.

Protecting Your Intellectual Property

Your logos, branding, and ideas are part of what makes your business unique. Failing to protect them can lead to lost revenue if others use your work. We assist you with trademarks, copyrights, and other legal protections that help you keep control over your intellectual property and avoid costly conflicts.

Staying Compliant With Regulations

Fines and penalties from missed filings or overlooked regulations can add up fast. We help you stay current on business licenses, tax filings, and employment laws, so you don’t have to worry about unexpected fees impacting your bottom line.

Guiding Business Structure Changes

Whether you’re merging, expanding, or restructuring, we help you choose the best setup to limit your personal liability and reduce your tax obligations. Making smart choices with our Troy business lawyer in your corner can lead to long-term savings as your business evolves over time.

Handling Employee Issues

Employment claims, wage disputes, and wrongful termination cases can cost businesses thousands. We help you set up clear policies, handle contracts, and address workplace concerns early, which helps you avoid expensive legal action down the road.

Preparing For The Future

Business succession planning is key to long-term success. We work with you to create a plan that supports your goals and reduces future costs, whether you’re passing the business to family or selling it. This preparation helps protect your hard work and keeps expenses under control when ownership changes.

Let Us Help You Protect Everything You’ve Built

Teaming up with our Troy business lawyer is not just about solving problems—it’s about helping you avoid them in the first place. At Gudeman & Associates, P.C., we focus on giving your business the legal support it needs to grow without wasting money on avoidable issues. If you’re ready to protect your business and save on future costs, contact us today to schedule a free consultation with one of our experienced and versatile attorneys.

Business Law FAQs

Building and running a business means more than just day-to-day operations. Whether you’re forming a new venture or making decisions about an existing one, questions are bound to come up. Understanding how Michigan law applies can help you make informed choices. At Gudeman & Associates, P.C., we guide business owners through a wide range of legal matters. Below, we’ve answered some of the questions we hear most from Michigan entrepreneurs and business owners. For tailored legal guidance, we recommend consulting with one of our client-recommended Troy business law attorneys.

What Is The Process For Dissolving A Business Entity In Michigan?

The process for dissolving a business entity in Michigan depends on the type of business and how it’s structured.

If you operate a corporation or limited liability company (LLC), you’ll need to file the appropriate dissolution documents with the Michigan Department of Licensing and Regulatory Affairs (LARA). It’s also important to resolve outstanding debts, notify creditors, close tax accounts, and distribute any remaining assets according to state law.

We can assist you in making sure your business is properly closed out, helping avoid legal or tax issues in the future. Working with our Troy business lawyer during dissolution can help reduce unnecessary delays or filings.

How Does Michigan’s Tax Structure Impact Small Businesses?

Michigan’s tax laws affect small businesses in a few key ways. Most businesses are required to pay the Michigan Corporate Income Tax (CIT), which is a flat 6% rate. However, depending on your business structure, you may instead be subject to the Michigan Business Tax or be taxed as a pass-through entity. Additionally, if you sell goods or certain services, you’ll need to register for sales and use tax.

Tax responsibilities also vary depending on whether your business hires employees or operates in multiple states. With our firm in your corner, you’ll have support in evaluating tax obligations that align with your business type and operations.

How Can I Protect My Business’s Intellectual Property?

Protecting intellectual property is a key part of maintaining a business’s value and reputation. You can register trademarks for your business name, logo, or slogan.

Copyrights protect creative works, while patents apply to inventions or certain designs. If you have confidential business methods or processes, you may also want to use non-disclosure agreements to safeguard those ideas.

It’s important to file your intellectual property with the appropriate federal or state office. Our Troy business lawyer can help you determine what protections apply and how to document or register your intellectual property properly.

How Do I Obtain An Employer Identification Number For My Business?

An Employer Identification Number (EIN) is issued by the IRS and used to identify your business for tax purposes. You can apply online through the IRS website, and most applications are processed quickly. You’ll need an EIN if you plan to hire employees, open a business bank account, or file business tax returns.

Even sole proprietors often choose to get an EIN to avoid using their personal Social Security number in business transactions. If you’d like help applying or have questions about how an EIN fits into your structure, we’re here to help.

How Does Michigan Law Address Non-Compete Agreements?

Michigan courts generally allow non-compete agreements, but they must be reasonable in scope, duration, and geographic reach. The agreement must also protect a legitimate business interest, like customer relationships or confidential information. If it’s too broad, a court may not enforce it.

It’s best to work with your attorney when drafting or reviewing a non-compete clause to make sure it reflects your business goals and follows Michigan law. We help business owners draft enforceable terms that strike the right balance between protection and fairness.

Put Our Experience In Your Corner

If you’re facing legal decisions about forming, operating, or dissolving a business, we’re here to support you. At Gudeman & Associates, P.C., our Troy business lawyer provides practical legal advice tailored to your business goals. Contact us today to schedule a no-obligation consultation and find out how we can help you move forward with confidence.

Troy Business Infographic

Business Law FAQs

Whether you’re launching a new business or running an established company, legal questions often come up. From licenses and home-based operations to legal disputes and structural choices, understanding how business law applies to your situation can help you avoid problems and make informed decisions. Our Troy business lawyer works with owners at every stage to help them address common legal concerns and protect their operations.

Do I Need A License For A Small Business In Michigan?

Most likely, yes. Michigan requires licenses or permits for many types of businesses, even small or home-based ones. What you need depends on your industry and location. For example, if you’re opening a restaurant, salon, daycare, or selling certain products, you’ll need specific state and possibly local licenses.

Some businesses may also need a sales tax license or zoning approval. We can help you determine the appropriate licensing based on your services and where you operate, so you’re not caught off guard down the line.

Can I Run My Business From My Home?

In many cases, you can legally operate a business from your home, but there are restrictions. Zoning laws may limit the type of work allowed in residential areas, and some cities or counties require home occupation permits.

If customers will be coming to your home, or if your business involves inventory, signage, or equipment, you may need extra approvals. It’s also important to check with your homeowners’ association, if applicable. We’re here to guide you through the process so your home-based business stays compliant with local rules.

Which Structure Is Right For My Business?

Choosing the right legal structure depends on your goals, tax situation, and plans for growth. Sole proprietorships and partnerships are easy to set up, but they don’t offer personal liability protection.

LLCs are a popular choice because they’re flexible and provide limited liability. Corporations—either S-Corp or C-Corp—are better suited for companies planning to raise capital or scale quickly.

Each structure comes with different tax obligations, filing requirements, and legal responsibilities. We’ll help you weigh the pros and cons based on your specific needs.

What’s The First Step In A Business Lawsuit?

If you’re considering legal action or just received notice of a lawsuit, the first step is to assess the situation with a business attorney. You’ll want to gather relevant documents—contracts, communications, or financial records—and discuss your goals.

Whether you’re trying to collect payment, defend against a claim, or enforce a contract, early legal guidance helps protect your rights and identify the best path forward. Our Troy business lawyer works directly with clients to develop a clear strategy before heading into litigation.

What’s The Difference Between Commercial And Business Law?

While these terms are often used interchangeably, commercial law is generally a subset of business law. Business law covers a wide range of topics, including forming a company, managing employees, and handling disputes.

Commercial law tends to focus more on transactions—sales, contracts, banking, and trade. In practice, there’s a lot of overlap, and both areas are important to running a business effectively. Whether you’re signing agreements or resolving conflicts, we help you handle legal matters with confidence.

Business Law Glossary

Troy, MI business lawyer support can make all the difference in the long-term success of your company. From business formation to employee management, a knowledgeable legal team helps protect what you’ve built and helps you make informed decisions. Below, we’ve defined several common legal terms and phrases that matter most to business owners. These explanations are meant to offer practical guidance and clarity around important aspects of business law.

Articles of Incorporation

Articles of Incorporation are the official documents filed with the state to legally create a corporation. In Michigan, this document is submitted to the Department of Licensing and Regulatory Affairs (LARA). It typically includes the corporation’s name, purpose, registered agent, and number of authorized shares. Filing the articles is a required first step if you plan to form a C-corporation or S-corporation.

Once filed and accepted, the corporation becomes a separate legal entity from its owners. This allows the business to enter contracts, own property, and assume debt under its own name. If you’re forming a new corporation, we’ll help you prepare and file these documents properly and avoid delays in the approval process.

Operating Agreement

An Operating Agreement is a document that outlines the internal rules and structure of a Limited Liability Company (LLC). Although Michigan doesn’t require this document by law, it’s strongly recommended for both single-member and multi-member LLCs. The agreement typically defines how profits are distributed, how decisions are made, and what happens if a member leaves or passes away.

Without an Operating Agreement, your LLC defaults to Michigan’s state rules, which may not reflect your business’s specific needs. We draft Operating Agreements that are tailored to your business goals and clarify expectations between members, reducing the risk of future conflict.

Buy-Sell Agreement

A Buy-Sell Agreement is a binding contract that governs what happens to a business owner’s share if they retire, pass away, or choose to leave the company. Often used in partnerships, LLCs, and corporations with multiple shareholders, this agreement prevents disputes by clearly defining terms for valuation, ownership transfer, and funding mechanisms.

A common approach includes funding the agreement with life insurance policies, which can be used to buy out the departing owner’s share. We prepare buy-sell agreements that align with your succession goals and keep your business on stable footing during times of change.

Non-Compete Clause

A Non-Compete Clause is a contractual term that limits a former employee or business partner from starting a competing business within a specific area and timeframe. Michigan allows non-compete agreements, but they must be reasonable and support a legitimate business interest, such as protecting confidential information or client relationships.

We help you draft non-compete clauses that are enforceable in Michigan courts and reflect the actual risks to your business. Vague or overly broad clauses often fail when challenged, so careful drafting is essential.

Business Succession Plan

A Business Succession Plan is a strategy for transferring ownership or leadership of a business when the current owner steps down or can no longer operate the company. This plan can include identifying potential successors, setting a timeline, and preparing legal documents to support the transition. It can also address how assets are transferred and how the business will be valued.

Succession planning isn’t just for retirement. It also covers unexpected events like illness or sudden death. We work with clients to build plans that minimize disruption and help preserve the company’s value and operations for the next generation or new ownership.

A well-organized business benefits from strong legal planning. Whether you’re drafting internal agreements, preparing for future changes, or managing current operations, having clear and enforceable documents in place helps reduce uncertainty and protect your investment. At Gudeman & Associates, P.C., we partner with Michigan business owners to develop strategies that support long-term stability and compliance.

Let’s talk about how we can support your business goals with practical legal solutions. Contact us today to schedule a no-obligation consultation with one of our experienced attorneys.

Get Support With Your Business Questions

Business law covers many areas, and having reliable legal guidance can make all the difference. At Gudeman & Associates, P.C., we work with business owners throughout the region to handle legal questions, prevent issues, and respond when disputes arise. If you’re looking for a Troy business law attorney you can trust, contact our firm today to take the next step toward protecting your business.