Moving Through The Probate Process With Confidence

For assistance with the probate process, contact our Southfield, MI probate lawyer today. Probate is the legal process by which the estate and inheritors of a deceased person’s estate are reviewed. This process includes examining and determining the validity of the will, distributing belongings, property, and assets, paying debts and taxes, and more. While the probate process can be complicated, with the help of our experienced lawyer, it can be made easy. To discover how our team can help provide guidance and assistance throughout the probate process, schedule a consultation with Gudeman & Associates, P.C. today. For more than 50 years, our lawyers have used their experience and knowledge of the law to ensure you, your family and your business are protected.

What Does Probate Entail?

The probate process includes a variety of steps to prove that the will of the deceased is valid and is carried out properly according to their wishes. This includes verifying the will, appointing a personal representative, identifying heirs and beneficiaries, identifying and distributing assets and property, transferring ownership of investments, paying taxes and debts, settling disputes, and more. If try to do this alone, these processes can be long, complicated, and costly for the beneficiaries involved. Our probate attorney will help you understand the implications of the probate process and move through it in the most efficient manner possible.

How A Probate Lawyer Can Help You

Our probate attorney helps you deal with probate in the most timely and cost-effective manner while also protecting your interests and the wishes of the deceased. Our probate lawyer will evaluate the will in question and verify its legality. We will then aid with identifying, evaluating, and distributing assets, paying debts and taxes, and resolving disputes between beneficiaries. We will handle the legal requirements of the probate process and ensure that all necessary legal steps are taken in order to execute the will as the deceased intended.

Can Probate Be Avoided?

There are specific laws in Michigan that govern the probate process and establish which assets are governed by probate. Consulting with our experienced Southfield probate lawyer is the best way to understand the implications of your specific case and whether probate is necessary. One common way to avoid probate is to create a living trust rather than a will. Living trusts may be more complicated to set up and maintain while the author is living, but after their passing, the process of distributing assets is much easier and probate is often avoided.

Contact An Experienced Lawyer Today

While the probate process may seem daunting, with the help of our knowledgeable and experienced lawyer, it can be made easy. Our team will work hard to protect the interests of the deceased and our clients and ensure that every step of the process is carried out efficiently, smoothly, and legally. It is our job to handle this legal system so that you may take care of your personal needs while knowing that your future is in good hands. You do not have to take this responsibility on alone. Our team is ready to help you move through the probate process with ease.

Understanding The Role Of A Probate Attorney

Dealing with the loss of a loved one is an emotionally draining experience, but our lawyer can help you deal with the aftermath. This process, known as estate administration, can be complex, involving everything from validating the will to distributing assets and paying off debts. During such a challenging time, having a trusted legal advisor to handle these responsibilities can provide peace of mind and allow you to focus on grieving and healing.

Why You Need Skilled Legal Guidance

The primary task following a death is the execution of the will, where the contents are reviewed and authenticated in court. This process ensures that the deceased’s wishes are honored accurately and lawfully. Our attorney plays an important part here by ensuring that the will is presented and executed correctly, addressing any claims that might arise, and helping resolve disputes amicably among beneficiaries.

Our legal team will efficiently handle all filings and court appearances, so that that all procedural requirements are met promptly and correctly. They also manage the intricate task of gathering all the deceased’s assets, paying outstanding debts, and ensuring rightful distribution to the beneficiaries.

Legal Representation Throughout The Probate Process

By taking over the legal formalities, our legal team allows you to deal with the personal and familial aspects of your loss. This can be particularly comforting during a time when emotional resilience is low. They also provide invaluable advice on potential tax implications, helping minimize the estate’s tax liabilities through strategic planning and legal insights.

Tailored Services Offered By Gudeman & Associates, P.C.

When selecting a firm to handle the estate, it is critical to choose one that not only understands the law but also appreciates the emotional impact of the situation. At Gudeman & Associates, P.C., we offer a compassionate yet comprehensive service that addresses all aspects of estate administration. Our team has over 100 years of collective experience, and we offer free consultations so you can decide whether a probate lawyer from our office is the right choice for you.

Ensuring Smooth Estate Management

Handling an estate can involve several issues, especially if there are significant assets or challenging family dynamics. Sometimes, estates need to be managed over several years, especially if there are ongoing obligations such as trusts that benefit minors or other dependents. Our attorney is instrumental in setting up these arrangements and ensuring that they function as intended over time.

Start Securing Your Legal Support Today

If you are faced with the responsibility of managing a loved one’s estate, it is important to seek professional legal help early to ensure that the process goes as smoothly as possible. Managing an estate is no small task, and it requires both legal acumen and a sensitive touch.

Reach out to us today to discuss how we can support you through this difficult time. By entrusting the legalities of estate administration to our capable hands, you can focus on what truly matters—honoring the memory of your loved one and supporting your family.

Southfield Probate Infographic

Southfield Probate Statistics

Contested probate cases, in which individuals dispute the validity of a will or the distribution of an estate, are relatively uncommon. Research indicates that approximately 5 percent of all wills are contested. Although that number may seem low, given that millions of wills are probated annually, this percentage translates to a substantial number of contested cases each year. The most common grounds for contesting a will include allegations of undue influence, lack of testamentary capacity, and failure to adhere to required formalities.

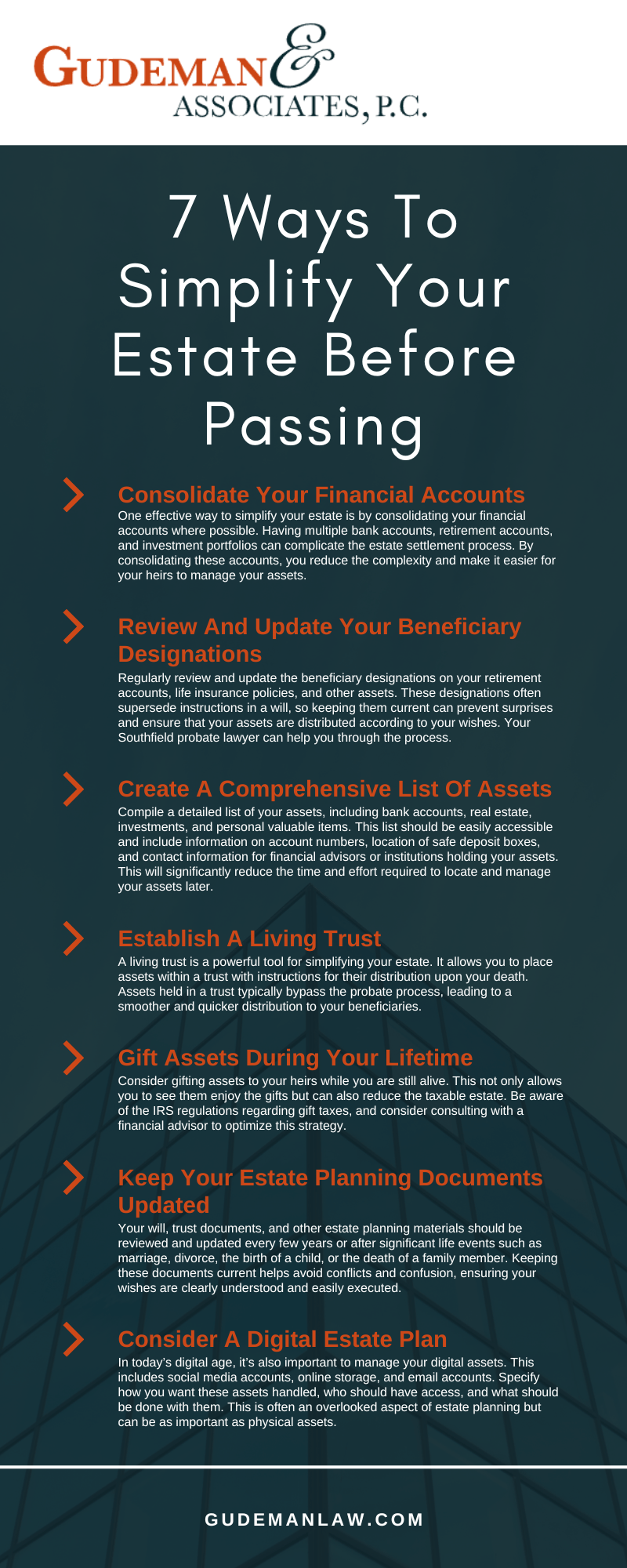

7 Ways To Simplify Your Estate Before Passing

Our probate lawyer can help you make your passing easier on your loved ones. At Gudeman & Associates, P.C., we’ve helped thousands of clients throughout southeastern Michigan, and our legal experience ranges from estate planning to tax law and beyond. We can help simplify your estate:

1. Consolidate Your Financial Accounts

One effective way to simplify your estate is by consolidating your financial accounts where possible. Having multiple bank accounts, retirement accounts, and investment portfolios can complicate the estate settlement process. By consolidating these accounts, you reduce the confusion and make it easier for your heirs to manage your assets.

2. Review And Update Your Beneficiary Designations

Regularly review and update the beneficiary designations on your retirement accounts, life insurance policies, and other assets. These designations often supersede instructions in a will, so keeping them current can prevent surprises and ensure that your assets are distributed according to your wishes. Our probate attorney can help you through the process.

3. Create A Comprehensive List Of Assets

Compile a detailed list of your assets, including bank accounts, real estate, investments, and personal valuable items. This list should be easily accessible and include information on account numbers, location of safe deposit boxes, and contact information for financial advisors or institutions holding your assets. This will significantly reduce the time and effort required to locate and manage your assets later.

4. Establish A Living Trust

A living trust is a powerful tool for simplifying your estate. It allows you to place assets within a trust with instructions for their distribution upon your death. Assets held in a trust typically bypass the probate process, leading to a smoother and quicker distribution to your beneficiaries.

5. Gift Assets During Your Lifetime

Consider gifting assets to your heirs while you are still alive. This not only allows you to see them enjoy the gifts but can also reduce the taxable estate. Be aware of the IRS regulations regarding gift taxes, and consider consulting with a financial advisor to optimize this strategy.

6. Keep Your Estate Planning Documents Updated

Your will, trust documents, and other estate planning materials should be reviewed and updated every few years or after significant life events such as marriage, divorce, the birth of a child, or the death of a family member. Keeping these documents current helps avoid conflicts and confusion, ensuring your wishes are clearly understood and easily executed.

7. Consider A Digital Estate Plan

It’s also important to manage your digital assets. This includes social media accounts, online storage, and email accounts. Specify how you want these assets handled, who should have access, and what should be done with them. This is often an overlooked aspect of estate planning but can be as important as physical assets.

Contact Us Today To Get Started

At Gudeman & Associates, P.C., we are here to help guide you through every step of the estate planning process. If you’re ready to start simplifying your estate, contact us today, and see how a Southfield probate lawyer from our office can help.

Southfield Probate Lawyer FAQs

Probate can be confusing, especially when figuring out legal processes after a loved one’s passing. Many residents in Southfield, MI, have questions about probate, including what it involves, how long it takes, and who handles the estate. Below are answers to common questions to help clarify the probate process.

What Is Probate?

Probate is the legal process of validating a deceased person’s will and distributing their assets. It involves identifying assets, paying debts, and ensuring that remaining property is distributed to beneficiaries. If no will exists, the court follows Michigan intestacy laws to determine asset distribution.

How Long Does Probate Take In Michigan?

Probate timelines vary depending on the estate’s size and complexity. Smaller estates may take a few months to settle, while larger estates with disputes or significant debts can take over a year. Michigan law provides streamlined processes for smaller estates, which can help reduce the time required.

Do All Estates Go Through Probate?

No, not all estates go through probate. Assets with designated beneficiaries, such as life insurance policies or retirement accounts, usually avoid probate. Jointly owned property and assets held in trusts are also exempt. Understanding whether probate applies depends on how the deceased structured their estate.

Can Probate Be Avoided?

Yes, probate can often be avoided with proper estate planning. Setting up a trust, naming beneficiaries on financial accounts, and jointly owning property are effective ways to bypass the probate process. Working with a legal professional to create a plan can save time and reduce costs for your loved ones.

What Happens If There Is No Will?

When someone passes away without a will, their estate enters intestate succession. Michigan laws determine how assets are divided among heirs, typically starting with spouses and children. Probate still occurs, but the court oversees the entire process to ensure assets are distributed according to state law.

Who Handles The Probate Process?

The probate process is overseen by a personal representative, also known as an executor. This person is either named in the will or appointed by the court. The representative manages tasks like filing paperwork, paying debts, and distributing assets to beneficiaries. Legal guidance is often helpful to ensure everything is handled correctly.

What Costs Are Involved In Probate?

Probate costs include court fees, attorney fees, and expenses for filing necessary documents. These costs vary based on the estate’s size and whether disputes arise. Discussing your situation with our attorney can help you estimate potential costs.

Contact Our Probate Lawyer Today

Dealing with probate in Southfield, MI, can feel overwhelming, but help is available. If you aren’t a lawyer, don’t go this alone. Our experienced legal team will equip you with the tools you need to get through probate while fighting for your rights.

Gudeman & Associates, P.C., will give you guidance through every step of the probate process to make sure your assets are distributed according to Michigan law. Schedule a consultation today to discuss your unique situation and explore your options.

Steps Of The Probate Process

If you’re facing the probate process in Southfield, MI, it’s important to understand the steps involved. Working with our Southfield, MI probate lawyer can make this process smoother. Gudeman & Associates, P.C., with over 100 years of combined experience handling probate cases and an A+ rating with the BBB, has helped many clients successfully manage the legal and financial aspects of estate administration. We will outline the essential steps of the probate process, offering a clearer picture of what to expect.

Filing The Petition And Opening The Estate

The first step in the probate process is filing a petition with the probate court to officially open the estate. This petition typically includes the decedent’s will (if one exists) and a request to appoint an executor or personal representative. The court will review the petition and confirm the will’s validity. If no will is found, an administrator is appointed, and the estate is processed according to Michigan’s intestacy laws. Our Southfield probate lawyers can guide you through this process to verify that all the necessary documents are filed correctly.

Appointing An Executor Or Administrator

Once the petition is filed and the court accepts it, the next step is appointing an executor or administrator to manage the estate. If the decedent left a valid will, it will usually name an executor. If there is no will, the court will appoint an administrator. The executor or administrator is responsible for overseeing the estate’s administration, paying off debts, and distributing assets. Our estate executor lawyer makes sure that this responsibility is handled with care and in compliance with all legal requirements.

Notifying Creditors And Beneficiaries

The next step is to notify creditors and beneficiaries of the estate. This includes sending notices to anyone who may have a claim against the estate and informing heirs about the probate proceedings. The executor must also publish a notice in the local newspaper to alert potential creditors who may not be directly involved. Our will planning lawyers can assist in drafting and distributing these notices properly to avoid any delays in the process.

Inventorying And Appraising The Estate’s Assets

Once the creditors have been notified, the executor must take inventory of the decedent’s assets. This includes real estate, bank accounts, personal property, and any other valuables. The assets need to be appraised to determine their value, which is crucial for tax purposes and the distribution of assets. Having our estate settlement lawyer involved in this step can be very beneficial, as we can help determine the proper valuations and verify that all assets are accounted for.

Paying Debts And Taxes

Before any assets can be distributed to the beneficiaries, the estate must settle any outstanding debts, including credit card bills, mortgages, and personal loans. The estate is also responsible for paying any applicable estate taxes. The executor must file tax returns, including both income and estate taxes, and make sure that all debts are resolved. This can be a complicated step, but our trust execution lawyers can provide assistance to verify that the debts are settled in a manner consistent with state and federal law.

Distributing Assets To Beneficiaries

Once all debts, taxes, and expenses have been paid, the executor or administrator can begin distributing the remaining assets to the beneficiaries. The will or Michigan’s intestacy laws will guide this process. The executor is responsible for making sure that all property is transferred correctly and in accordance with the decedent’s wishes. If disputes arise among beneficiaries, our Southfield probate lawyers can assist in resolving these issues.

Get The Legal Support You Need

The probate process can be overwhelming, but it doesn’t have to be. At Gudeman & Associates, P.C., we can ease the burden of estate administration and make sure everything is handled properly. Contact us today to schedule a consultation and get the support you need.

Probate FAQs

Many families come to us with questions about how probate works and whether they need legal support to move forward. If you’re looking for clear answers, we’re here to help. Below, we’ve addressed some common questions people often ask about probate, estate planning, and the legal processes involved. If you have more questions or are seeking more personalized advice, don’t hesitate to reach out to us and set up a free consultation with our Southfield probate lawyer.

What’s The Difference Between A Probate Lawyer And An Estate Lawyer?

The titles “probate lawyer” and “estate lawyer” are often used to describe similar work, but there are some differences.

A probate lawyer typically helps guide you through the court process after someone passes away. This may include filing documents, helping with asset distribution, and resolving any issues that come up during probate. An estate lawyer, on the other hand, usually focuses on planning ahead—things like setting up wills, trusts, and powers of attorney.

However, it’s common for our Michigan attorneys to handle both estate planning and probate cases, which helps provide ongoing support to you and your family.

How Long Do You Have To File Probate?

In Michigan, there is no strict deadline to open probate, but it’s generally best to do so within a reasonable time after someone passes. Most people file within a few weeks or months, depending on the situation. Waiting too long can create unnecessary problems with the estate.

Creditors, taxes, and property issues may become more difficult to handle the longer you wait. When you work with our Southfield probate lawyer, we help you figure out the right timing and take care of the required paperwork, so everything stays on track.

What Happens If You Don’t File Probate?

If probate isn’t filed when it should be, several problems can arise. Assets may be left in the deceased person’s name, which makes selling or transferring property difficult. Bills might go unpaid, and beneficiaries could be delayed in receiving what they’re entitled to.

In some cases, the court might step in to appoint someone to handle the estate, which takes control out of your hands. To avoid these issues, it’s important to enlist one of our knowledgeable and compassionate lawyers who can help you move forward with the necessary steps.

What Happens If A Beneficiary Doesn’t Claim Their Inheritance?

If a beneficiary doesn’t claim their inheritance, the funds or assets may eventually be turned over to the state. Before that happens, the personal representative of the estate usually makes several attempts to contact the person.

If no response is received, the unclaimed property is handled according to Michigan law. This is one of the reasons why keeping good records and working with our Southfield probate lawyer can make things easier. We help manage communication and make sure every step is handled properly.

Do I Need A Lawyer For Probate In Michigan?

While Michigan doesn’t legally require you to hire a lawyer for probate, having legal support is highly recommended. Probate can involve court filings, asset management, and handling debts, which are difficult to manage alone. Working with our team helps you avoid mistakes and keeps the process moving smoothly. We take care of the details so you can focus on your family and what matters most during a difficult time.

Legal Guidance Matters

At Gudeman & Associates, P.C., we’ve been committed to serving individuals, families, and businesses across Southeast Michigan for over 45 years. Our legal team brings together a versatile array of experience in the areas of estate planning, business law, taxation, real estate, and bankruptcy. We pride ourselves on offering comprehensive legal solutions tailored to your unique needs. Our dedication to our clients and our community has earned us an A+ rating with the Better Business Bureau.

We understand that any legal issue or process can be extremely overwhelming. That’s why we offer no-obligation consultations to discuss your specific situation and provide guidance on the best path forward.

If you have questions or need assistance with probate or any other legal matter, we invite you to reach out to our Michigan law firm. Our experienced attorneys are ready to provide the trusted counsel you need to navigate these important decisions. Contact us today to schedule your free consultation and take the first step toward securing your future.